German public-private funding model for the development of H2 transport networks

An essential component of the transition process towards climate neutrality is the development of a hydrogen backbone distribution network at both national and European level. To implement the so-called hydrogen economy, the development of a backbone network for the transport and distribution of renewable hydrogen is one of the key factors.

Nevertheless, there are several uncertainties about the level of renewable hydrogen production and the spread of the inputs and outputs related to the hydrogen value chain. Meanwhile, both supply and demand in hydrogen production are awaiting the planning of a central hydrogen transport network at the intra-national and European level.

German funding concept

The German federal government has developed a funding concept which aims to enable the private sector to develop a central hydrogen network and to ensure a subsidiary state security. The main purpose of the German approach is the development of a central, privately financed hydrogen distribution network through a network fee, similar to the gas and electricity networks.

At the beginning of the deployment stage, when there are still a small number of network users, the high initial investments cannot be fully handed over to the network users yet. With no upfront cap, initial fees would be prohibitively high in the first years, which will be impossible for producers and consumers to afford. This would generate a payback risk that would inhibit private sector investments into hydrogen distribution networks. To encourage investment in hydrogen networks, the federal government intends to provide risk protection for investors by means of a so-called amortisation account (AMK) and a subsidiary state assumption of the payback risk. Network fees under this model will be restricted to the so-called increase fee (Hochlaufengelt in German). For the first years, the difference between the initially high network construction costs and the low revenues of a few network users will be charged to an amortisation account. The regulatory authority (BNetzA) will be responsible for making up the difference between the approved network costs and the fee revenue collected by paying the network operators. Over the following years, once a significant number of users are connected to the network and the revenue from the connection fee exceeds the costs of network construction and operation, the amortisation account will gradually be balanced, with an initial target year of 2055 as the date for full amortisation.

The increase fee methodology shall undertake a periodic review for connection fees to ensure a balanced amortisation account. Beyond 2028, the state regulator will check the feasibility of the financing model every three years and will adjust the fee for new connections as required to achieve the set goals.

However, a major limiting condition to be considered within this funding model is that the price of network fees may only be adjusted so far as not to endanger the increase in new connections. The inherent risk of the amortisation account not balancing until 2055, due to a high investment cost and not so high revenues due to a limited fare (and a reduced number of connections) should be covered by a subsidiary state guarantee for balancing the amortisation account. If the amortisation account is not balanced until 2055, the shortfall which cannot be allocated to revenue can be reduced by partial government subsidies from 2035 onwards, as long as there is a positive forecast of the amortisation account evolution. If reviews show that the increase in renewable hydrogen production does not develop as planned and that network operation cannot be financed by a regulated grid connection fee after 2055, the federal government is entitled to use the amortisation account from 2038 onwards and request a refund of the loan amount paid up to then. If the central network operators cannot finance the cash franchise at the dissolution of the AMK amortisation account, the whole network at its residual value minus the value of its franchise.

Figure 1. H2 distribution network (SynerHy)

The long-term goal of this German funding scheme is to complete the commissioning stage of the distribution network by 2055 and to have this network funded by the customers and regulated by the BNetzA, as mentioned above, similar to the current networks for electricity and gas.

Fraunhofer Institute for Energy Infrastructure Technical Report

A study conducted by four German institutions (FNB-Gas Fernleitungsnetzbetreiber, BMWK Bundesministerium für Wirtschaft und Klimaschutz, BMF Bundesfinanzministerium and BNetzA Bundesnetzagentur) on behalf of the Federal Ministry of Economics has been prepared under the direction of the Fraunhofer Institute (download the original article here).

Scenarios and calculation tools

The report carries out a comprehensive review of the calculation tool developed by the German gas transport operator FNB. According to this report, the developed calculation tool is accurate in terms of cost calculation and describes the costs of the proposed core network and the funding model in an appropriate form.

The Fraunhofer Institute proposes several scenarios:

- Baseline scenario for expected hydrogen production growth:

- Deceleration scenario in hydrogen production growth.

- Discounted network fee scenario

- Fixed construction cost increase scenario

- Annual increase of construction costs scenario

- Fixed operating costs increase scenario

- Yearly increase in operating costs scenario

- Higher residual accounting values scenario

- IPCEI Constrained Funding Scenario

- Very harsh scenario

- Increase in network fees scenario

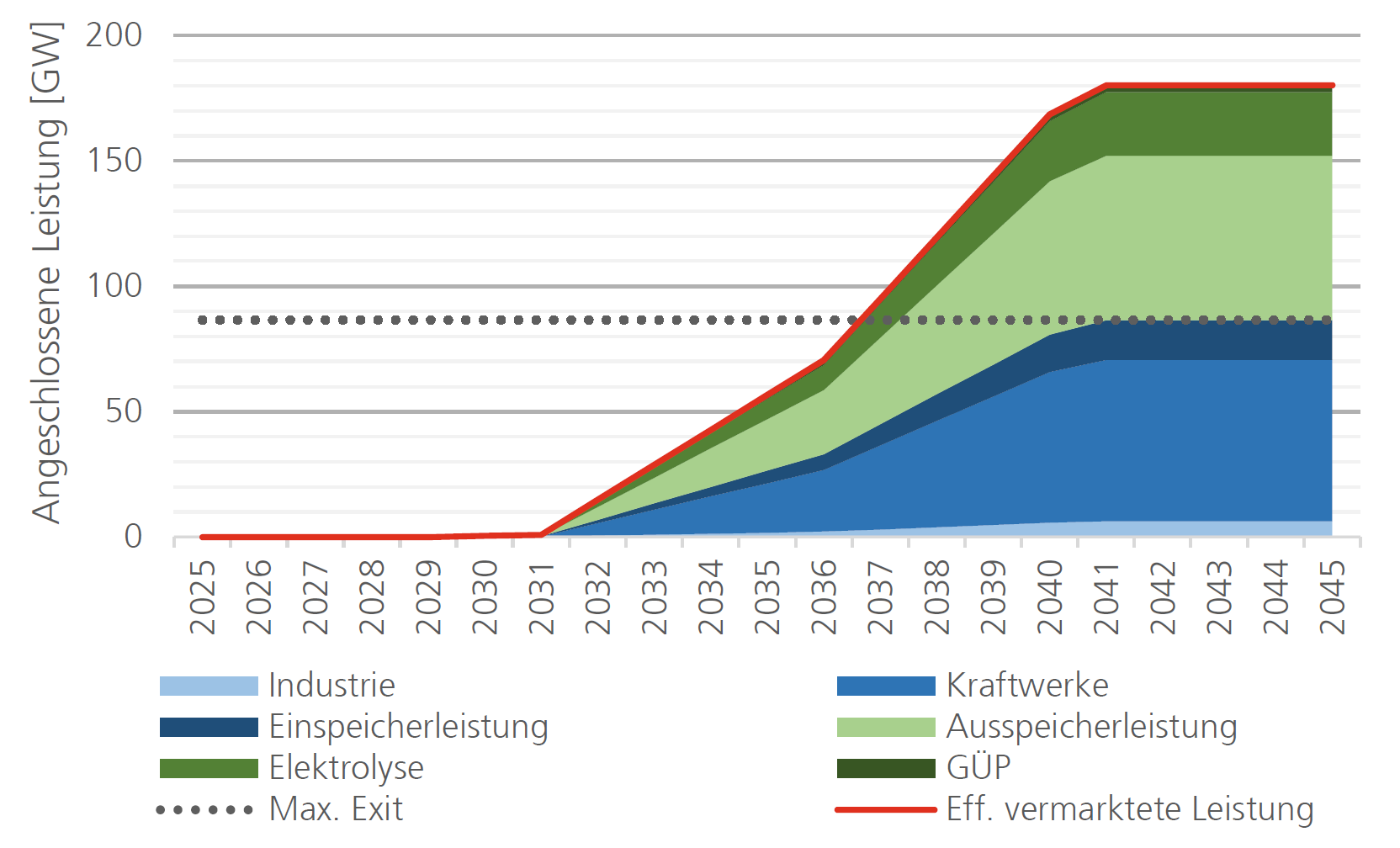

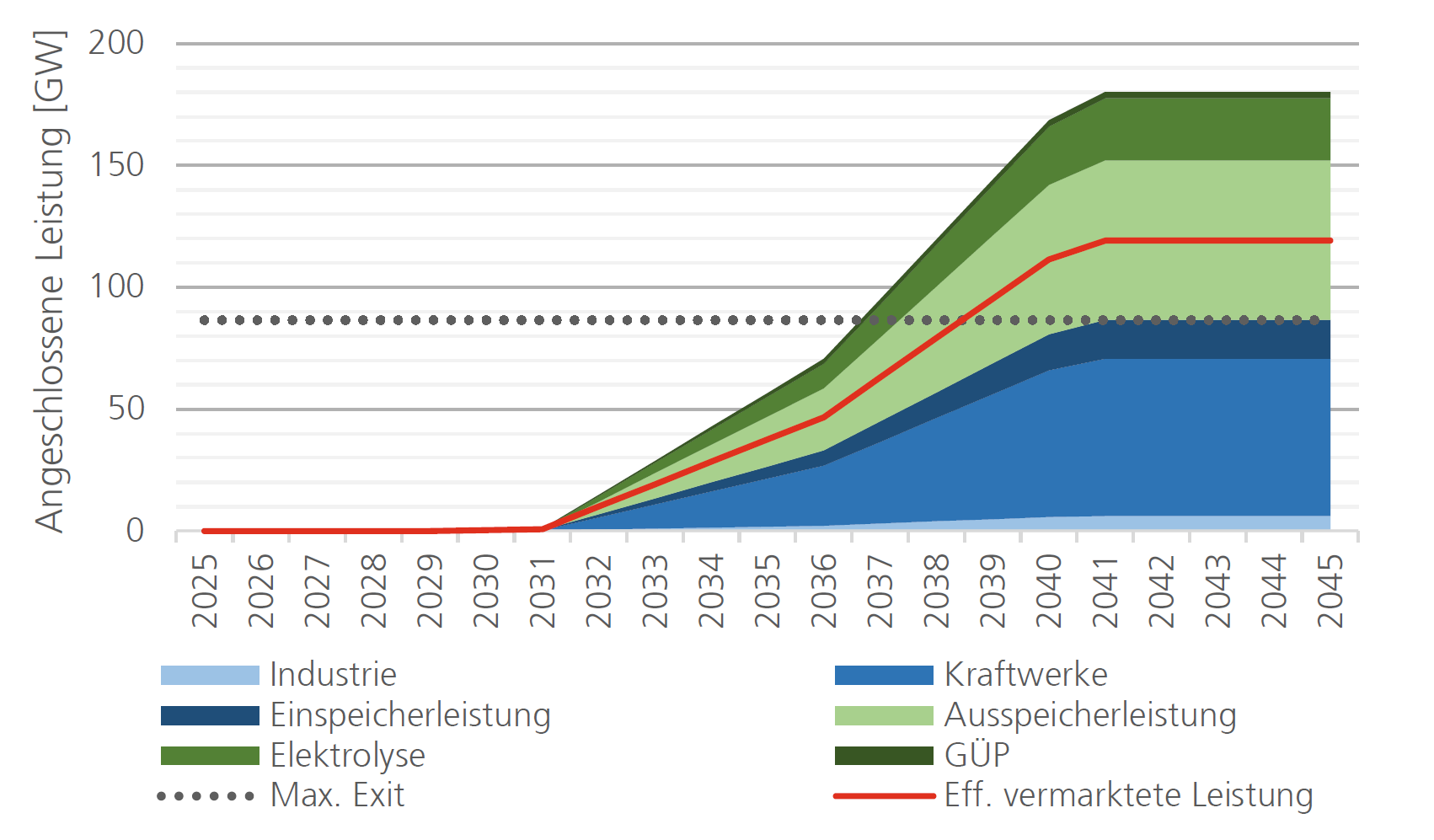

Figure 2. Comparison of a baseline scenario versus the harsh scenario

Both figures in Figure 2 illustrate the growth of the connected power in the distribution grid (ordinate axis connected power, angeschloßene Leistung). The top figure shows a baseline scenario, achieving a maximum output capacity for the central hydrogen grid of 86.5 GW in 2038. From this year onwards, the capacity of 180.2 GW is connected and pays full grid fees, as storage facilities will not receive any discount on the grid fees under this scenario. A grid fee of 15 €/kWh/h/a would be enough.

The very harsh scenario (figure below) requires a fee uplift of approximately 35 €/kWh/h/a over the entire period to balance the amortisation account. Hence, the amortisation account would peak at more than €20 billion. The red line shows the effective marketed revenue for grid fees, being lower than the grid-connected power in the figure below, which implies a very high amortisation account under this scenario.

Different parameters which may influence the funding model

The report examines the planned funding scheme for the hydrogen core network in Germany, focusing on several scenarios to identify the effects that may influence the funding mechanism, such as:

- Hydrogen production forecast delay.

- Increased construction costs.

- Limited funding.

An increase in the production level has the greatest impact on the funding model. According to the report, if the hydrogen economy boost is well implemented and linked to the development of the central hydrogen distribution network, there will be a win-win situation for the proposed funding model. In such a case, the network fees would only have to be slightly increased in the following years after its implementation. The maximum level of the planned amortisation account (AMK) would remain below ten billion euros and a grid fee of 15 €/kWh/h/a would be enough to balance the AMK amortisation account until 2048, which is meant to cover grid costs with a longer amortisation period. Germany will use this account to provide a cash inflow over the period when there are not yet enough hydrogen users to finance the grid costs through fees. Once more users are connected to the grid and fee revenues increase, the AMK should be balanced no later than 2055, according to the current plan.

However, in case the hydrogen economy does not develop as expected or if the expected production cannot be optimised for technical reasons, the funding model’s situation will deteriorate significantly. If the network is either underused or built too early, the funding model will face major challenges. This would dramatically impact the funding, reaching the amortisation account peaks of more than 20 billion euros. This would require a fee increase of 35 €/kWh/h/a to balance the amortisation account by 2052. “Unfortunately, this is a very real danger,” warns Benjamin Pfluger of Fraunhofer IEG, who led the report. “The new strategy for combined cycle power plants states that they will be set to work solely with hydrogen between 2035 and 2040, becoming one of the main users of the grid. Meanwhile, all grid customers will have to pay for the initial underuse of the grid for a long period of time, which is hardly feasible without state funding.”

The authors of this report recommend a continuous review and adjustment of the integrated gas and hydrogen network development plan. By shortening or delaying plans whenever there is a foreseeably lower demand, it is possible to avoid unnecessary or premature investments and to reduce deployment costs of the distribution and transport network. All this requires the willingness of the network operators.

Under this proposal by the Fraunhofer Institute, the German state and power system operators will only have to balance the amortisation account if an overall increase in hydrogen fails.

Conclusions

The development of a hydrogen transport network entails high levels of investment. This investment has to be paid for through fees charged to the users of the network, which includes both hydrogen producers (who will supply hydrogen to the network) and end-users (industry, power plants, etc.). It is likely to be the end-consumers on whom the cost of the connection fees would be charged, since the producers will charge that cost in the final price of the hydrogen.

If these charges are very high, they will constitute a deterrent to the use of hydrogen by potential end-consumers and thus an obstacle to achieving decarbonisation targets.

Therefore, public funding is needed to encourage investments in this type of core infrastructure to implement a hydrogen economy, in particular in the early stages, where the lack of infrastructure users may imply long payback periods.

For this purpose, Germany has set up a funding mechanism to ease investments in hydrogen transport infrastructure and to guarantee affordable prices for potential users. This mechanism will allow cost-effective infrastructure investments without requiring a current demand for such infrastructure, while allowing a steady growth in demand.

This mechanism is designed to ensure repayment of the initial aid as soon as a considerable number of users are reached, thus allowing the connection fees to pay for both the infrastructure investment and repayment of the aid received.

Nevertheless, there is a time limit in the mechanism designed by Germany for repayment of the funding provided, regardless the number of users connected to the grid. If the revenues of the infrastructure owner are not high enough to be able to repay the state aid, the default may lead to a possible infrastructure handover to the state.

Due to the uncertainty in the deployment of hydrogen technologies and their use within different sectors, such a feature of the German mechanism may strongly discourage investments.

To understand the scope of this funding mechanism, the Fraunhofer Institute has analysed a number of hydrogen use scenarios, investment costs and charge fees. This study shows that there is a long-term risk of a lack of deployment of hydrogen technologies within the industry, in particular within energy-intensive sectors. This is an inherent risk, regardless of any funding mechanism.

The study’s main conclusion is that all network funding scenarios and business plans point to a need for government funding and subsidiary state guarantee plans to guarantee the investments made by the industry against any undesired scenario.

The main advice of the report is to plan the deployment of hydrogen transport infrastructure according to the needs for such infrastructure, even suggesting the possibility of cancelling approved hydrogen transport and distribution line construction projects if there are several overlapping events such as a delay in the start-up of hydrogen production and/or consumption projects, or an increase in construction and operation costs.

REFERENCES

FNB Gas (2023): Entwurf des gemeinsamen Antrags für das Wasserstoff-Kernnetz. Hg. v. Vereinigung der Fernleitungsnetzbetreiber Gas e.V. (FNB Gas). Berlin. Online verfügbar unter https://fnbgas.de/wasserstoffnetz-wasserstoff-kernnetz/, zuletzt geprüft am 10.02.2024

BNetzA – Beschlusskammer 4 (2019b): Beschluss BK4-19-076. Hg. v. Bundesnetzagentur (BNetzA). Online verfügbar unter https://www.bundesnetzagentur.de/DE/Beschlusskammern/1_GZ/BK4- GZ/2019/BK4-19-0076/BK4-19-0076_Beschluss_download.pdf?__blob=publicationFile&v=1, zuletzt geprüft am 07.12.2023