India signs up to the Renewable Hydrogen race. Japan boosts efforts again.

India has an acute need to decarbonise its economy. It is currently the world’s third largest CO2 emitter, responsible for 7% of global emissions, only behind China and the United States. Emission levels associated with the use of fossil fuels lead to poor air quality, which means that 35 of the 50 most polluted cities worldwide are in India.

At the same time, India is also highly energy-dependent due to the need to import fossil fuels and is one of the world’s largest fossil fuel imports. Up to 85% of the oil and 53% of the natural gas needed for electricity generation are imported.

Figure 1. Indian Chemical and Refining Companies

Regarding current hydrogen consumption, India is the world’s third largest hydrogen consumer, mostly due to the refinery processes required for import treatment and fertiliser production, accounting for about 8 Mt per year, out of which 99% was non-renewable hydrogen.

Government investment

The Indian government anticipates a fourfold increase in hydrogen demand by 2050, due to the decarbonisation needs arising from the iron and steel industry and heavy transport. Based on these analyses, the government has implemented a series of initiatives to promote the development of the renewable hydrogen sector, as shown below:

National Hydrogen Mission

This initiative was launched in 2021 and approved in 2023, with the goal of turning the country into a hydrogen valley for the production and export of this diatomic molecule. The government plans to invest 2.2 billion euros up to 2030.

This initiative aims to achieve 5 Mt of renewable hydrogen production per year by 2030, requiring 60-100 GW of electrolyser capacity to be directly fed by 125 GW of renewables. It would reduce carbon emissions by 3.6 Gt and energy imports by no less than $246 billion by 2050.

90% of the initial investment will be allocated to the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme, whilst the remaining 10% will be allocated to hydrogen production incentives. Guidelines for renewable hydrogen production and electrolyser manufacturing are detailed within the programme.

The National Hydrogen Mission comprises two stages. The first stage, which runs between 2022 and 2025, aims to develop a sector with greater capacity and more competitive capabilities, thereby helping to reduce the price of the product.

The second stage, which runs from 2026 to 2030, will focus on expanding the deployment of more competitive renewable hydrogen to new sectors and its establishment as the main energy source in those sectors where it has already been implemented. To ensure a successful deployment, there will be new working groups among the ministries involved. Companies will be allowed to install and export renewable capacities, such as solar or wind, throughout the country, to produce renewable hydrogen of electrolytic origin, whether on their own or through external partners.

Green Hydrogen Policy

Launched in February 2022, it grants concessions on interstate electricity transmission charges, financial assistance to projects, land acquisition benefits and access to renewable energy purchases.

Interministerial report on R&D to support Green Hydrogen in India

This paper aims to promote research and development of new technologies related to the extraction and use of renewable hydrogen.

There are also plans to remove fossil fuel subsidies, which will become part of the investment to decarbonise the country through renewable hydrogen.

As mentioned above, the country hopes to achieve these objectives by enhancing its energy independence through the use of renewable electricity generation technologies, mainly solar and wind power, with off-shore wind power being considered as well. Solar photovoltaic (PV) seems to be of major significance, owing to the country’s geographical and meteorological conditions, most notably the state of Rajasthan, where there is a desert that has the potential for developing a large PV infrastructure. The government plans to turn the country into one of the world’s largest exporters of renewable hydrogen. Therefore, the government forecasts that around 70% of the hydrogen produced will be exported worldwide.

Renewable Hydrogen Auctions

Similar to the European Hydrogen Bank, India also has an auction system that aims to fix a bonus per kilogram of hydrogen produced. Under this scheme, a bonus of 50 rupees per kilogram (€0.55) will be paid in the first year, 40 rupees in the second year and 30 rupees in the third year. These bonuses will be granted to eight companies out of thirteen.

Furthermore, and new within the sector, India also has auctions for manufacturing electrolysers, in which a maximum incentive of 4,400 rupees (€48.5) per kW is proposed. There were 21 bids in this auction, fourteen of them from international companies and seven from Indian companies.

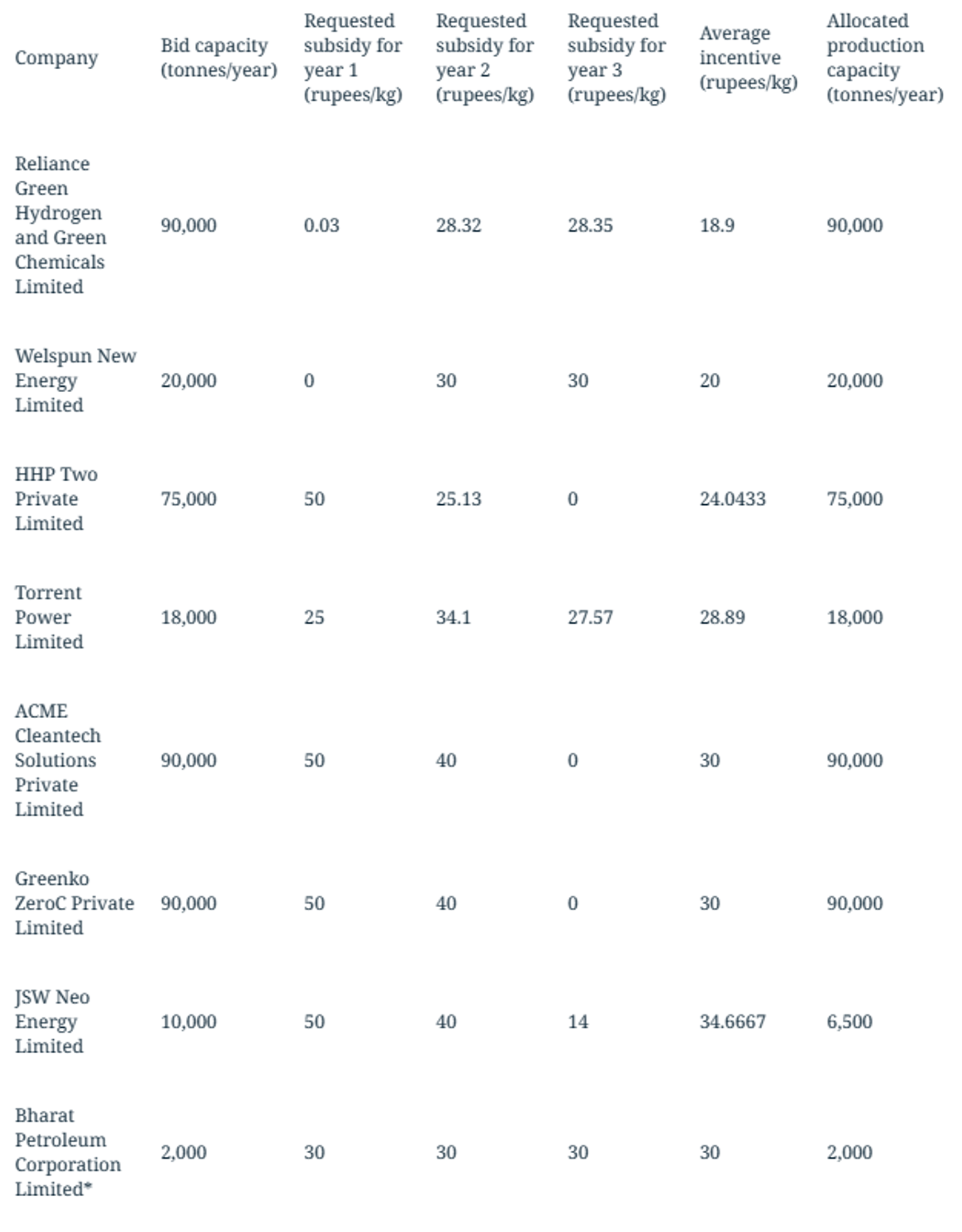

Last 15th of January, those companies that will benefit from this aid were published, being the following the winners of the bonuses per kilogramme produced:

Figure 2. Winning Companies of the hydrogen production auction

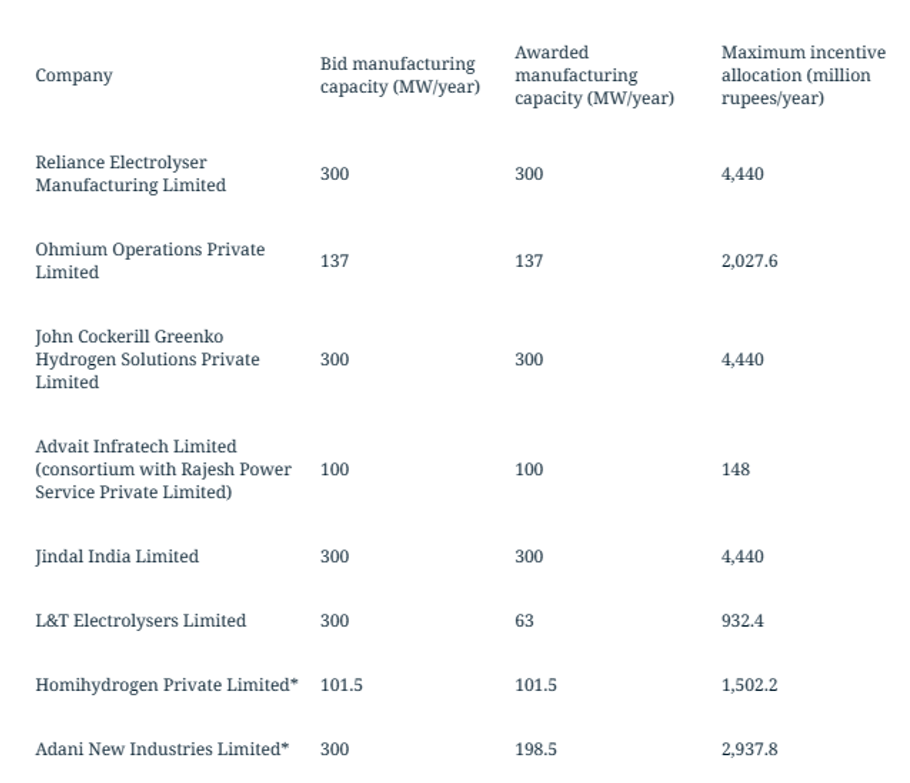

And for the electrolyser developers’ bid, the winning companies are:

Figure 3. Winning Companies of the auction for electrolyser bonuses

Concurrently, the Indian government announced new auctions designed to pool industry demand and tender fixed payments for production and supply. Both auctions will focus on:

- Renewable hydrogen producers that are engaged in supplying hydrogen to refineries. These companies expect to have the same incentives as previously mentioned, Rs. 50, Rs. 40 and Rs. 30 for successive years. In order to qualify for the auction incentives, the maximum annual production will have to be 200,000 tonnes of hydrogen.

- Renewable ammonia producers, as long as the hydrogen is produced on the same site. No incentives will be given to these companies, only Rs 8.82; Rs 7.06; Rs 5.30 per kilogram of ammonia, since for every kilogram of NH3 there are 176 grams of hydrogen. Ammonia production will be limited to 550,000 tonnes per year.

Japan boosts its renewable hydrogen sector

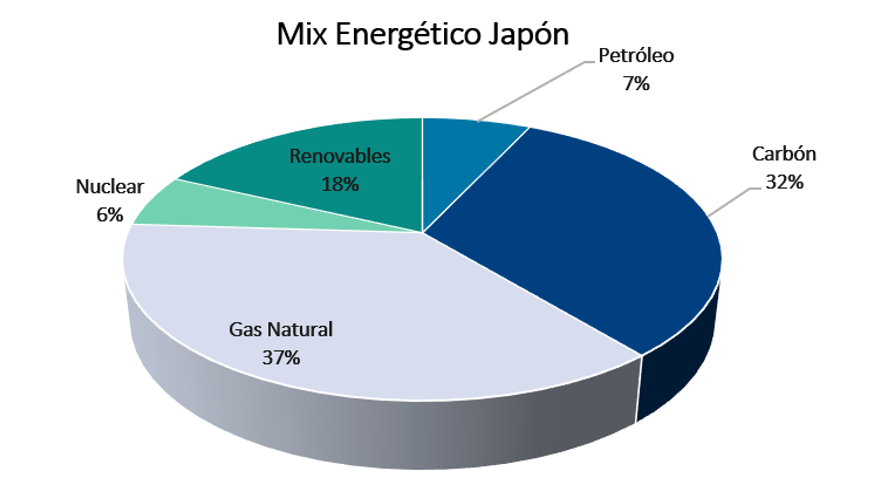

Nowadays, Japan’s electricity generation is based mainly on fossil fuels, up to 76% of its energy mix, which means that there is an urgent need to decarbonise its activity through the implementation of a large amount of renewable energies, which could be used to generate a large part of the country’s hydrogen. Prime Minister Kashida’s government also intends for hydrogen to serve as a way to stabilise the country’s electricity supply and promote economic growth where hydrogen generation plants are being considered.

Figure 4. Japanese energy mix

The Japanese government intends to provide grants worth 18.75 billion euros from green transition bonds funds to companies which succeed in producing hydrogen with lower emissions than the hydrogen produced by natural gas reforming. These subsidies are meant to compensate for the gap in prices between non-renewable hydrogen and renewable or low-emission hydrogen. The organisations promoting the subsidies suggest that 3.4 kg CO2/ kg H2 is the upper limit of emissions required for hydrogen to qualify as low emission. This is not the only measure within the hydrogen value chain, since Japan became one of the first countries to develop a hydrogen strategy in 2017, in which they expected to reduce their carbon emissions by 46% in 2030.

Japan also plans to increase domestic hydrogen supply by 50% to 3 Mt by 2030 and 20 Mt by 2050. Asahi Kasei ranks among the companies expected to receive a large percentage of the government’s investment support, accounting for a large amount of the national production. The company developed the high-power alkaline electrolyser technology with which they expect to fulfil the Japanese government’s requirements.

The plan proposed in 2023 comprises a strategy based on five main stages:

1. Outline the basic hydrogen strategy by which the country expects to achieve the objectives of carbon neutrality and a hydrogen-based society.

2. Development of a specific hydrogen policy based on the premise S+3Es, which stands for safety + energy security, economic efficiency, and environment.

3. Draft Japan’s hydrogen and ammonia strategy under the following specific objectives:

-

- Transition from low-emission hydrogen to hydrogen produced by renewable energies and deployment of supply chain.

- Setting up an international hydrogen energy supply chain. Japan is strongly considering H2 imports from countries such as Australia or Brunei.

- Using ammonia and hydrogen for power generation.

- Use of hydrogen within the iron and steel industry as well as within sectors requiring high-temperature combustion.

4.Improve the competitiveness of the renewable hydrogen value chain by focusing on five areas where Japanese industry is ahead of foreign competitors, as shown below:

- Hydrogen production and supply.

- Decarbonisation of power generation.

- Fuel cells.

- Use of hydrogen within metallurgy and the chemical sector.

- Production of hydrogen by-products such as ammonia and recycled carbon products.

5. Creation of a safety standard for hydrogen use to reduce accidents within this sector.

To summarise, the 2023 Hydrogen Strategy has four clear goals:

- Increase Japan’s hydrogen and ammonia supply from 2 Mt to 3 Mt by 2023, followed by 12 Mt by 2024 and reaching 20 Mt by 2050.

- The strategy aims to lower the national cost per kg of hydrogen from 1112 yen (€6.89) to 333 yen (€2.04) by 2030, followed by 222 yen (€1.36) by 2050.

- Expand the production of electrolysis equipment manufactured on their own territory.

- Engage public and private investment in the hydrogen and ammonia supply chain through subsidies worth 15 trillion yen (approximately €14 billion) over the next 15 years.

Conclusions

The Indian government seems to be committed to industrial and business decarbonisation, like Europe and the United States, through renewable hydrogen, aiming to achieve neutrality by 2070, 20 years later than Europe and 10 years later than China. Major international and national companies have already proposed plans in the country, including TotalEnergís, Adani New Industries, Indian Oil Corp, Larse&Tourbo and ReNew Power, thus proposing major projects to accomplish the objectives.

These objectives are feasible from a technological and political point of view primarily as a result of the numerous trade agreements with China, which is currently the most competitive producer of this technology, as well as being privileged geographically by its proximity to the Asian giant. Such proximity could advance the government’s plans, since, compared to Europe, delivery times and final prices could be shortened due to the lesser need for transport.

Furthermore, these efforts to decarbonise the third most emitting country worldwide represent a hopeful future for the global economy, as it might be an example to other emerging countries, such as India, to end the use of fossil fuels in their power generation and industrial activities.

On the other hand, the decarbonisation of Japan by increasing power generation through renewables, nuclear energy and the production of renewable or low-emission hydrogen is a great opportunity to reduce emissions worldwide, as Japan is one of the countries with the highest population and population density. Moreover, given the isolated geography of the different islands that comprise the country, Japan could become totally energy independent by establishing a hydrogen pipeline transport network, which would set a great example for the rest of the world towards achieving a wholly energy-independent country. However, it will be difficult to implement this initiative without relying on imports from countries such as Brunei and Australia, with which Japan already has trade agreements in place.

REFERENCES