Renewable Hydrogen Leadership Contest

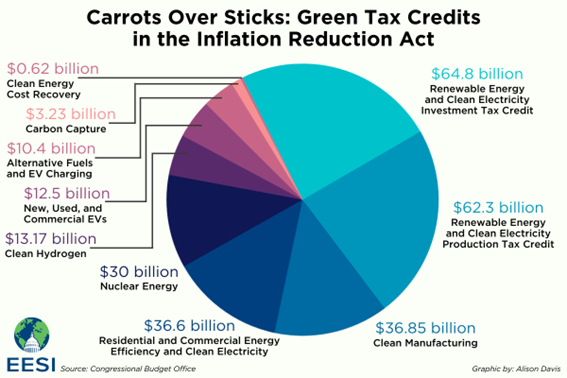

In Philadelphia, Pennsylvania, on 13th October 2023, Joe Biden announced the projects that will be funded by the first America’s Clean Hydrogen Hubs, comprising 8 billion dollars (7.5 billion euros), of which 7 billion dollars (6.59 billion euros) will be allocated exclusively to the development of the different valleys, financed by the Bipartisan Infrastructure Law (BIL). On the other hand, the US government of Biden-Harris, through the Inflation Reduction Act (IRA) and using 370 billion dollars (348 billion euros), of which 13.17 billion dollars (12.34 billion euros) will be allocated to clean hydrogen, aims to reduce the inflation rate by investing in innovation, development and production of renewable energies, which will include a tax reduction in the entire value chain of renewable technologies. Through this plan, the United States aims to lead the world towards the energy transition to the intensive use of renewable energy, especially technologies associated with the production of renewable and/or low-emission clean hydrogen, and to “build a domestic industry powered by domestic renewables” (US President Joe Biden).

This US government investment competes with European plans to lead the energy transition through an investment ranging from 186 to 470 billion euros in different funding sources, such as the Social Climate Fund, the Green Deal Industrial Plan and the Recovery and Resilience Facility, which is part of the NextGenEU. The American investment has a different implementation approach, whereby they prefer the independent development of different valleys with different objectives, whereas the European policy moves simultaneously towards the same objective for all member states.

Clean hydrogen (US) vs Renewable hydrogen (EU)

The aid schemes described above are designed to support the production and use of hydrogen that represents a positive environmental impact (i.e., reduced emissions). For this purpose, the characteristics that this hydrogen must meet are defined for each case.

On the other hand, the European Union’s Renewable Energy Directive (RED) requires a 70% reduction in greenhouse gas emissions for renewable fuels of non-biological origin (RFNBO). In the specific case of hydrogen, the requirement in the EU taxonomy is emissions below 3 kg CO2/kg H2.

Moreover, the RFNBO delegated act, a part of the Renewable Energy Directive, establishes the requirements that electricity used to produce hydrogen (through electrolysis) has to fulfil in order to qualify as renewable hydrogen and therefore benefit from existing support. These include concepts of additionality and geographical and temporal correlation between electricity generation and hydrogen production. It also allows for the origin of the electricity not to be 100% renewable and to have a number associated to it.

Across the Atlantic, the Inflation Reduction Act defines clean hydrogen as hydrogen with emissions below 4 kg CO2/kg H2. It also establishes a series of emission thresholds that define the tax reduction that the produced hydrogen receives. For hydrogen with emissions below 0.45 kg CO2/kg H2, the maximum reduction is achieved (0.6 $/kg H2). Between 0.45-1.5 kg CO2/kg H2 0.2 $/kg H2 is targeted, 0.15 $/kg for the range 1.5-2.5 kg CO2/kg H2, and 0.12 $/kg H2 if hydrogen emissions are between 2.5 and 4 kg CO2/kg H2.

Therefore, a first approach could conclude that hydrogen with emissions between 3 and 4 kg CO2/kg H2 can receive government support in the USA, while in the EU such hydrogen would not be considered renewable and would thus be excluded from any kind of support. However, detailed analysis of the emission calculation methodologies for both systems should be carried out in order to make an accurate comparison between both systems. For the EU, the calculation methodology is defined in the second RED delegated act, while for the US, the methodology is based on the ‘GREET model’ developed by the Argonne National Laboratory.

According to the content of the RED, it might be inferred that only electrolytic hydrogen would be considered for support in the EU. However, the EU taxonomy, which identifies which hydrogen is eligible for support in the EU, does not provide any restriction on how such hydrogen is produced, only on its level of emissions.

US Hubs

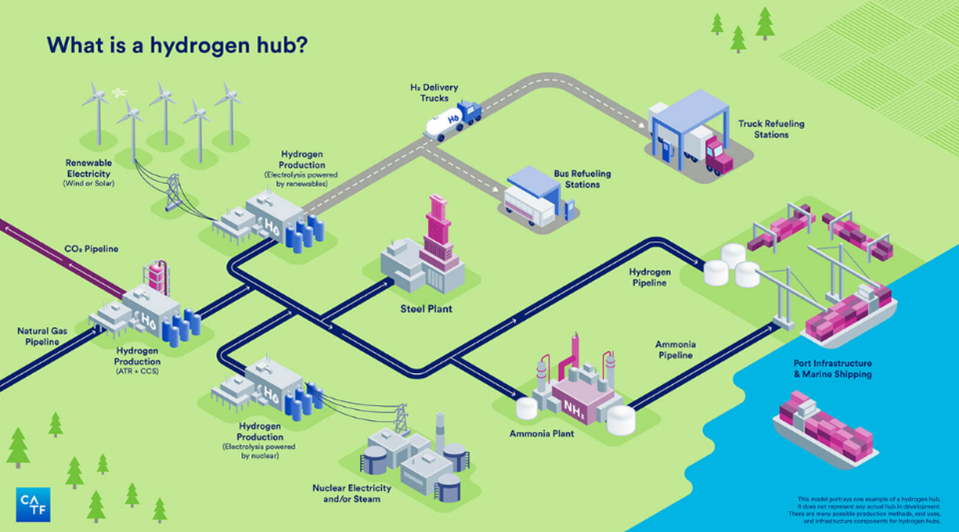

A hydrogen hub or valley is defined as an open innovation programme aimed at companies, researchers and entrepreneurs to formulate technological solutions based on challenges arising from the sector. This initiative represents a complete industrial ecosystem, covering the entire hydrogen value chain (production, transport, distribution and funding).

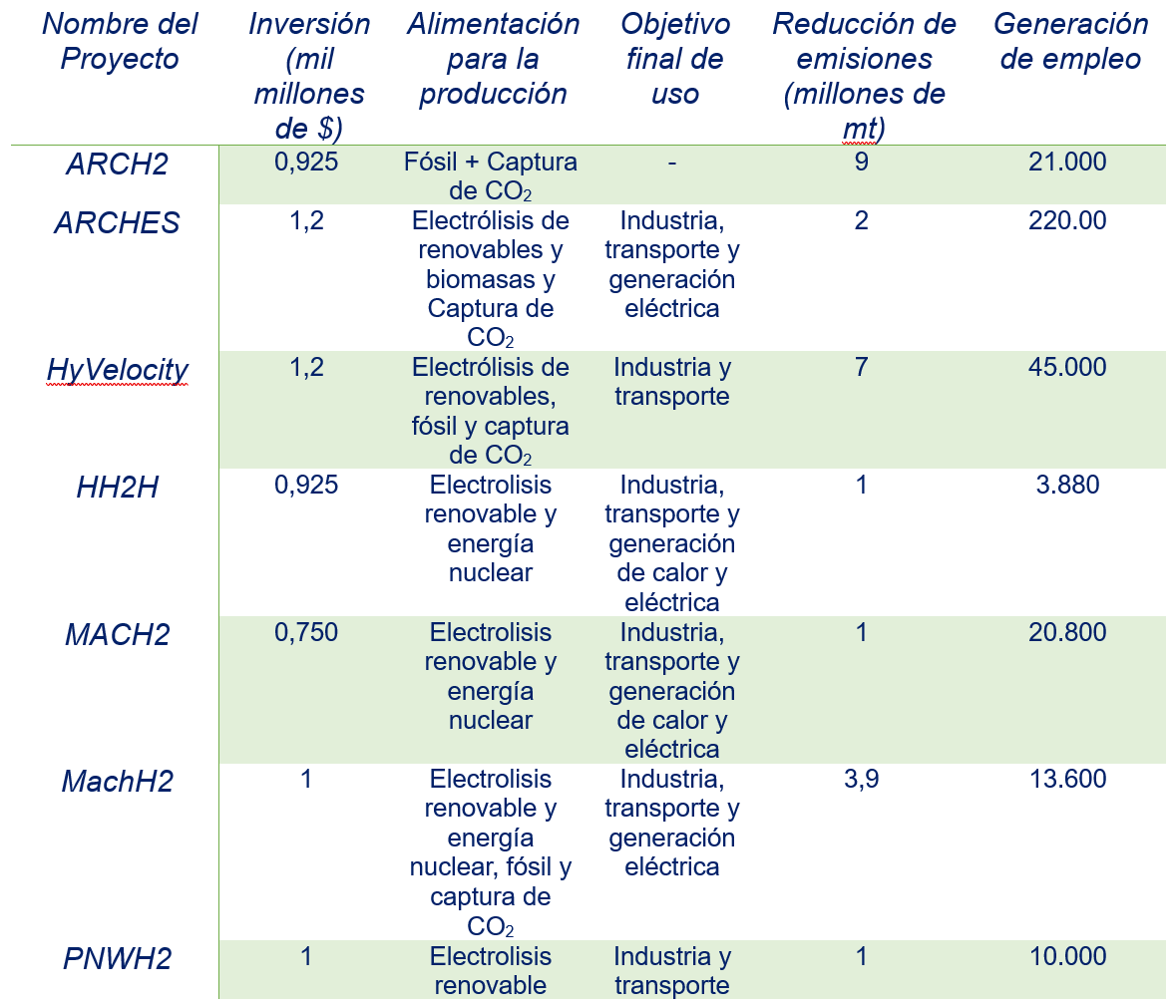

The H2Hubs project in the USA will promote seven regional clean hydrogen hubs throughout the country, with the goal of creating a catalyst for a national network for production, consumption, storage, distribution and end use of renewable hydrogen, as well as creating quality jobs associated with renewable energies. The H2Hubs funding aims at the collective annual production of 3 million metric tons of hydrogen, representing a third of the expected production target for 2030, as well as the reduction of emissions from sectors that are difficult to decarbonise, which represent a 30% of the total carbon emissions of the country. By combining all the Hubs, 25 megatons of CO2 per year will be reduced, equivalent to the annual emissions from 5.5 million petrol cars.

These Hubs, which have been promoted by the US government administration, can be seen in the following image, although we will provide a brief summary of each of them below.

Appalachian Regional Clean Hydrogen Hub (ARCH2)

This hub, located in the states of West Virginia, Ohio and Pennsylvania, will receive a total of 925 million dollars (870 million euros).

The hub aims to exploit the widespread access to natural gas in the region for producing renewable, low-cost, low-emission hydrogen by permanently storing the associated carbon emissions. Due to its strategic position, the production of cheap hydrogen is also intended to develop hydrogen pipelines and hydrogen refuelling stations, thereby reducing the cost of hydrogen distribution and storage. The project is also expected to reduce CO2 emissions by 9 million metric tons per year, thus improving the air quality, which has so far been overloaded with emissions and pollution.

California Hydrogen Hub; Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES)

This hub, located in the state of California, will receive a total of 1.2 billion dollars (1.13 billion euros).

The philosophy of this hub is focused on the production of clean hydrogen through the exclusive use of renewable energy sources, mainly solar energy sources, thanks to California’s geographical conditions, and biomass, as well as adapting the Californian port for the export via sea transport of the hydrogen produced. It aims to decarbonise transport at all levels in the State of California, ranging from public transport to heavy duty vehicles operating in the ports, hence reducing emissions by 2 million metric tons per year. This development on fuel cell-based vehicles will be a breakthrough for the future connection of the California hub with the Pacific Northwest hub.

Gulf Coast Hydrogen Hub; HyVelocity H2Hub

This hub, located in the state of Texas, will receive a total of 1.2 billion dollars (1.13 billion euros).

The Hub’s efforts will focus on the Houston region and the coastal area of the State. Large-scale renewable hydrogen production will be boosted by using natural gas-based technologies and subsequent carbon capture, and electrolysis powered by renewable energy, thereby harnessing the abundance of both renewable and natural gas resources to decrease the final cost of hydrogen, as well as the emission of 7 million metric tons per year. The end uses of the hydrogen produced will be industrial processes, ammonia, refineries, petrochemical uses and as fuel for the marine (e-Methanol) and automotive (fuel cells) sectors.

To achieve targets for price reductions associated with storage, the development of storage facilities using salt caverns, extensive access to hydrogen pipelines and multiple hydrogen refuelling stations are planned.

Heartlan Hydrogen Hub (HH2H)

This hub, located in the states of Minnesota, North Dakota and South Dakota, will receive a total of 925 million dollars (870 million euros).

Through the abundant energy resources of this region, the Hub aims to decarbonise fertiliser production within the agricultural sector by lowering the price of renewable hydrogen used for all ammonium nitrate production processes, thereby reducing emissions generated by 1 million metric tons. These measures can be implemented elsewhere across the country, especially where the agricultural sector is a major contributor to the economy of that region.

HH2H proposes the use of green hydrogen in electricity generation for public utilities in order to act as a catalyst for the whole country. Besides using open access to storage and connection infrastructures, to create an accessible network for future and current users.

Mid-Atlantic Clean Hydrogen Hub (MACH2)

This hub, located in the states of Pennsylvania, Delaware and New Jersey, will receive a total of 750 million dollars (705 million euros).

It will be responsible for decarbonisation through the use of hydrogen, as well as retrofitting old and existing refinery infrastructures to use renewable hydrogen in refineries. Renewable hydrogen production will be based on innovative electrolysis technologies powered by nuclear and renewable power plants. Furthermore, it will develop distribution infrastructures such as hydrogen refuelling stations which, along with advances in the development of production, will lead to a decrease in the price of hydrogen.

It aims to widen hydrogen applications from heavy transport to manufacturing, industrial process improvement, heat and power production, and thus reducing emissions by 1 million metric tons per year.

Midwest Alliance for Clean Hydrogen (MachH2)

This hub, located in the states of Illinois, Indiana and Michigan, with potential to spread to more states, will receive a total of one billion dollars (940 million euros).

It is located in a key industrial and transport corridor for the US, where decarbonisation through green hydrogen would reduce 3.9 million metric tons of CO2 emissions associated with sectors such as iron and steel industry, glass production, power generation, refining, heavy transport and aviation fuel. They plan to produce renewable hydrogen using the diverse and abundant energy supply in the area, which includes natural gas, nuclear power, as well as renewable energy.

Pacific Northwest Hydrogen Hub (PNWH2 Hub)

This hub, located in the states of Washington, Oregon and Montana, will receive a total of one billion dollars (940 million euros).

It aims for a dedicated hydrogen production through electrolysis technologies powered by the plentiful number of renewable resources in the area. This total investment in electrolysis technology is expected to play a key role in lowering the cost of electrolysers, thereby becoming more accessible to producers and consequently reducing the cost of hydrogen production. The Hub’s plans for the decarbonisation of heavy transport, using fuel cells, will be carried out alongside the California Hydrogen Hub, targeting a reduction in CO2 emissions of 1.7 million metric tons per year, as well as NOx emissions associated primarily with diesel-powered heavy transport.

Another objective is to connect the West Coast Hubs by developing a network of hydrogen refuelling stations to enable the growth of heavy transport on a renewable basis.

To sum up:

European policies on hydrogen support

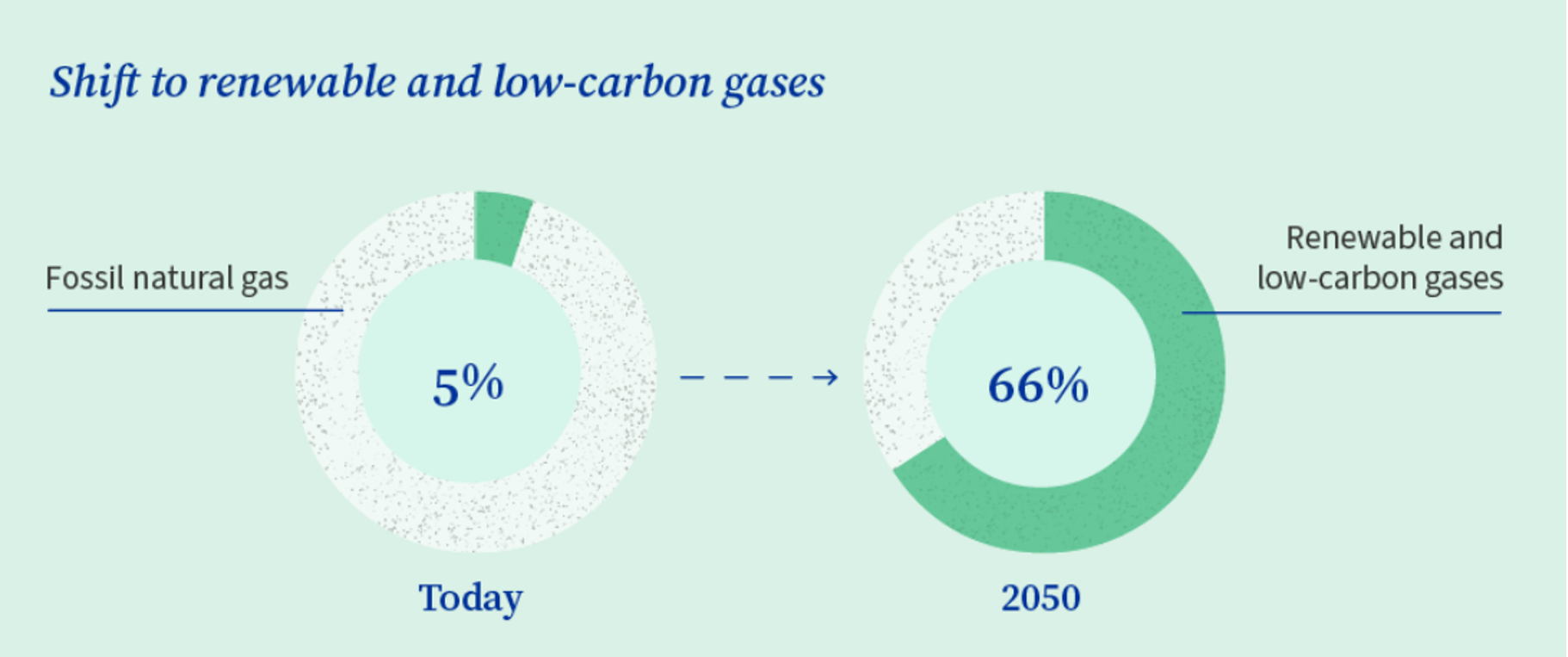

The EU hydrogen strategy and the REPowerEU scheme have set up a comprehensive framework to support the uptake of renewable and low-carbon hydrogen that will assist in decarbonising the EU in a competitive way, while reducing its dependence on imported fossil fuels.

The EU hydrogen strategy was agreed in 2020 and points out five areas for action: investment support, supporting production and demand, creating a hydrogen market and infrastructure, research and cooperation, and international cooperation.

Thereafter, the Fit-for-55 plan (July 2021) set out a series of legislative proposals that translate the European hydrogen strategy into a concrete European policy framework. Among these are proposals to set targets for the uptake of renewable hydrogen in industry and transport by 2030. It also includes a plan for the development of a decarbonised hydrogen and gas market, which includes proposals to support the creation of an optimal and dedicated hydrogen infrastructure and an efficient hydrogen market.

On the other hand, the REPowerEU plan (May 2022) forecasts a national production of 10 million tonnes of renewable hydrogen, plus a further 10 million tonnes to be imported from outside Europe, increasing the initial estimation of the Fit-for-55 plan (5.6 million tonnes). To achieve these targets, the total investment requirements are estimated at 335-471 billion euros, including 200-300 billion euros needed for additional renewable energy production.

While most of this amount is expected to come from private funding, public funding (through EU financial instruments and state aid) has an important role to play in triggering the private market initiative, in particular in the early development period of the hydrogen market.

Moreover, the NextGenerationEU recovery plan allows all EU countries to invest in hydrogen projects throughout the value chain. Investments have also been supported through Important Projects of Common European Interest (IPCEI) on hydrogen.

The first IPCEI, known as “IPCEI Hy2Tech”, including 41 projects and approved in July 2022, aims to develop innovative technologies across the hydrogen value chain to decarbonise industrial processes and the mobility sector, focused on end-users. In September 2022, the Commission approved “IPCEI Hy2Use”, which complements IPCEI Hy2Tech and will support the deployment of hydrogen-related infrastructures and the development of innovative and more sustainable technologies for the integration of hydrogen in the industrial sector. Finally, the Clean Hydrogen Partnership (replacing FCH 2 JU) was also established in November 2021 to support research and innovation in the hydrogen ecosystem. This agency will receive a total of €1 billion from the European Union over the period 2021-2027, which must be backed by a similar amount of private investment.

The RepowerEU plan also includes a “hydrogen booster” concept to scale up the deployment of renewable hydrogen, thus contributing to a faster energy transition and decarbonisation of the EU’s energy system. Among these boosters is the European Hydrogen Bank (for more information European Hydrogen Bank: Imminent release and auction schemes | SynerHy). This entity will support hydrogen production by paying a fixed price per kg of hydrogen produced (similar to the US IRA) for up to 10 years of operation. The first pilot auctions are currently being designed and will be launched in autumn 2023 and supported by €800 million from the Innovation Fund.

Furthermore, the European Commission has launched the European Clean Hydrogen Alliance to support these investments and the deployment of a hydrogen ecosystem overall. The main objective of this Alliance is to identify and create a clear portfolio of feasible investment projects, both public and private. At the same time, the Alliance will simultaneously facilitate cooperation on several large investment projects related to the renewable hydrogen value chain, including the IPCEI projects (Strategic Forum for Important Projects of Common European Interest).

Another initiative launched within support for the development of hydrogen technologies and their deployment is the Hydrogen Energy Network (HyENet), which is a platform formed by the representatives of the energy ministries of the EU countries to share information on best practices, experiences and the latest developments in hydrogen, as well as to work together on specific issues.

The purpose of these initiatives launched by the European Commission is to:

- Foster demand and create an EU hydrogen market; as well as a fast deployment of hydrogen infrastructure.

- Lower costs of renewable hydrogen production and distribution technology leading to lower supply and end-product costs, thus proving cost-competitive with fossil fuels, which are currently more affordable.

- Phase out fossil hydrogen as soon as possible.

- Certify the renewable origin of hydrogen produced in the EU as well as imported hydrogen, covering both production and transport to minimise carbon emissions.

- Evaluate whether existing pipelines can be reused for hydrogen transport and underground storage.

Brussels will allocate around €390 billion up to 2030 to promote the development of the aforementioned objectives. This investment will be distributed according to the different components of the hydrogen value chain. A substantial part of this investment, around EUR 280 billion, will be allocated to increase the renewable power used in green hydrogen generation through electrolysis. Another major investment, EUR 65 billion, will be implemented to develop and build infrastructure related to hydrogen transport, distribution and storage. Approximately one billion euros will be allocated to build 400 hydrogen refuelling stations, thereby quadrupling the existing ones, and could be supplied by local and regional electrolysers close to the stations.

Investments of €33 billion will be made for the development of different electrolysis technologies, with a different degree of technological maturity (Alkaline, PEM, AEM, SOEL). On the other hand, around €11 billion will be allocated to the development of technologies related to low-emission hydrogen (storage and carbon capture), with the final goal of implementing 100% renewable hydrogen in the infrastructures arising from the financed projects.

European Hydrogen Backbone

Among the biggest challenges ahead for the EU is the deployment of a hydrogen transport pipeline network to connect production and consumption points across the European Union, including the UK.

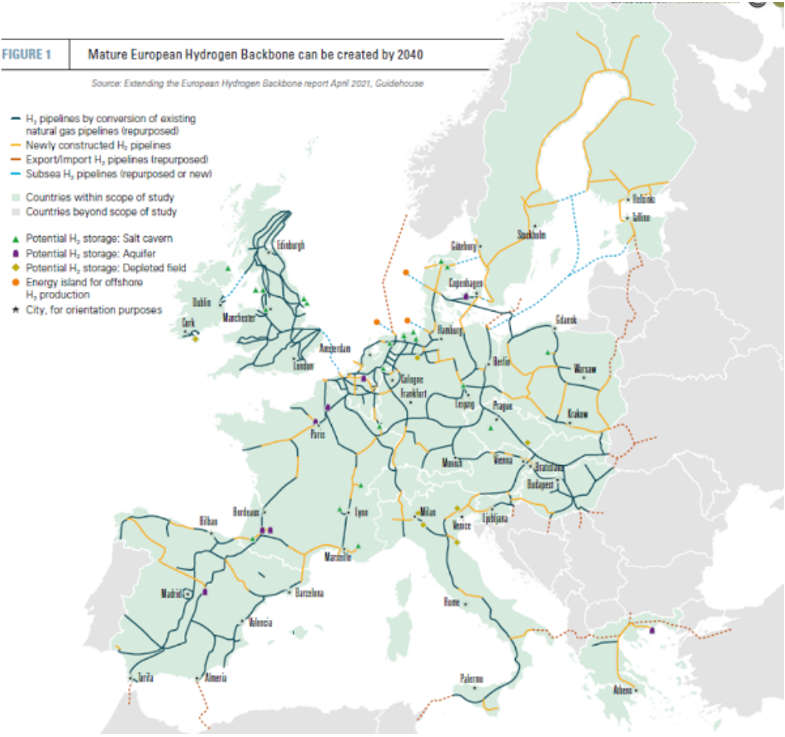

The European Hydrogen Backbone (EHB) initiative consists of 33 energy infrastructure companies and aims to define a hydrogen transport infrastructure, based on both new pipelines and the retrofitting of part of the existing infrastructure already deployed for natural gas transport.

The EHB’s analysis of the capacities of this infrastructure to accommodate the production and demand required by European policies estimates that a hydrogen supply network of approximately 53,000 km in length would be in place by 2040, mainly based on the retrofitting of existing infrastructure. This would both lower the costs of such infrastructure and allow the ongoing payback of an infrastructure whose use should decrease accordingly as natural gas consumption decreases, keeping up with the goals of decarbonisation.

In this same analysis, the EHB estimates that the investment cost would be around 80-143 billion euros. This also includes the use of undersea pipelines linking countries with offshore energy centres and potential export regions on the fringes of Europe.

Transporting hydrogen by pipeline involves a large investment. However, it is the most economical solution for transporting large quantities and connecting many production and supply nodes. According to the EHB, hydrogen transport would cost an average of EUR 0.11 to 0.21 per kg of hydrogen per 1000 km distance. If hydrogen is transported solely via underwater pipelines, the cost would be between EUR 0.17 and 0.32 per kg of hydrogen and per 1000 km transported.

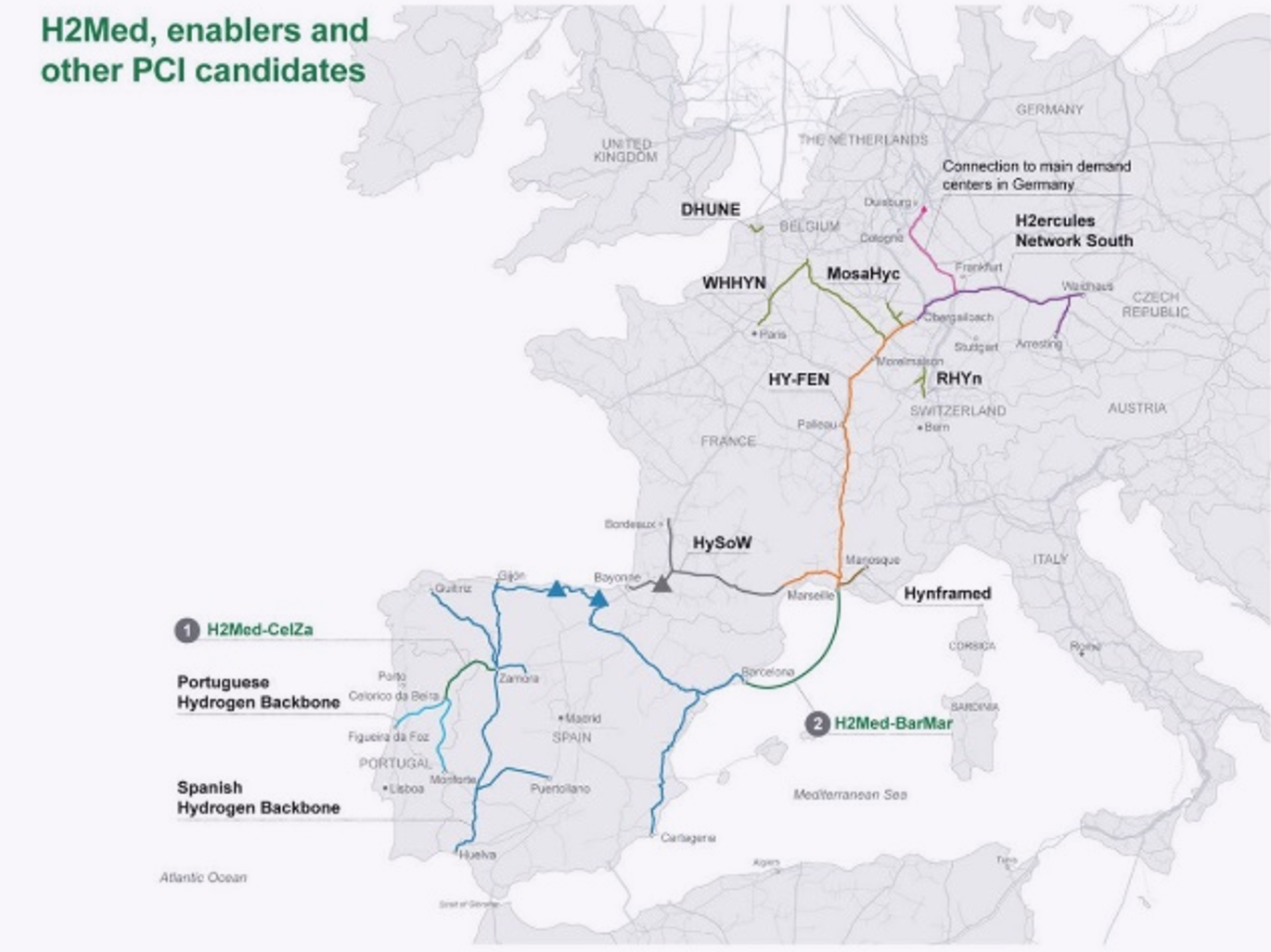

Projects such as H2MED are the initial step towards the establishment of this hydrogen pipeline transport network. The main objective of this project is to connect areas which have the potential to produce renewable hydrogen at low cost (Spain or Portugal) with countries with a high demand due to their large industrial sector (Germany or France).

Conclusions

Both the European Union and the USA are implementing policies to promote hydrogen production, as well as its integration into different sectors of society (industrial, transport, residential, etc.). In the USA, switching to a Democratic government has meant a very important commitment to become a world leader in the energy transition (allowed by China).

This recent US bid for leadership on the energy transition is a shock to the plans and policies pursued by the European Union. In such a specific sector as renewable hydrogen, Europe and the United States will have to share the many potential investors willing to innovate, develop and undertake projects within the hydrogen value chain.

Although the budgets for investment plans are on a similar scope, the different standards between the US and the EU to identify which hydrogen is eligible for support suggest that the EU would be at a disadvantage as the US has a greater number of alternatives for hydrogen production.

Nevertheless, since most of the hydrogen is likely to be for domestic consumption, both in the US and the EU, that advantage mitigates the impact of obtaining larger quantities of hydrogen at a lower price. Furthermore, having more restrictive emissions thresholds in Europe than in the US means that all European renewable hydrogen can be accepted as clean hydrogen in the US, but not all US clean hydrogen would be considered renewable in Europe. On this point, it is important to highlight the importance of the analysis of the carbon emission calculation methodologies considered to be able to accurately compare the emission thresholds involved.

It must also be remembered that the main reason for the use of clean or renewable hydrogen is to achieve decarbonisation targets, not to be a competitive economy. Therefore, it should be analysed in detail whether encouraging hydrogen production with emissions between 3 and 4 kg CO2/ kg H2 would really help to achieve these targets on time and as required.

In addition, as the US model allows them to encourage more hydrogen production technologies, there is a clear advantage in developing such technologies. This would lead to greater innovation that would allow the US to develop a key technological excellence in the export of hydrogen production technologies.

The United States has focused its efforts on the development of the different autonomous Hubs, exploiting the energy characteristics and potential end-product requirements in each Hub’s region. There are similar projects in Europe (Hydrogen Valleys) but on a smaller scale so far (e.g., the HEAVENN project in the Netherlands).

The different geographic, natural resource and political characteristics of the US and the EU lead to different strategies for supporting the development of hydrogen production. For example, due to the lack of fossil fuels in Europe, hydrogen production using natural gas (with CO2 capture) is not particularly promoted. However, this form of hydrogen production receives a lot of support in the US strategy, given its potential to use a plentiful resource for them and to maintain jobs in the gas sector, which could be heavily affected by decarbonisation targets.

The fact that the EU is a group of countries makes it difficult to implement strategies based on tax reduction, as in the case of the US IRA, because EU member states, rather than the EU itself, have the sovereignty to decide how to manage their tax system (within certain boundaries). Moreover, the interests of member states may be opposed among themselves, thereby raising difficulties to reach agreements on the best strategy. For instance, there has been considerable internal debate within the EU on whether to accept renewable hydrogen that is produced from nuclear power. Whereas France, whose electricity system is largely based on nuclear power, supported such recognition, countries such as Germany, which has a long antinuclear history, strongly opposed such consideration.

While some EU strategies for supporting renewable hydrogen production may be quite global, not considering the idiosyncrasies and potential of each member state, the EU also allows a certain degree of freedom to member states when it comes to funding their hydrogen projects (through the NextGenEU programme, for example).

Given the different features of the US and the EU, it is hard to identify which strategies are the most enlightened when it comes to promoting the production of cheap hydrogen and innovation in hydrogen technologies. The answer will only be given over time, as long as a change of government does not lead directly to a change of support for these technologies. Considering that the EU’s values and principles have been more stable over the last few years, and the level of polarisation in US politics, the US would be more vulnerable to a reversal of policy and thus these strategies could not be implemented as they are currently designed.

Meanwhile, China is delighted, aware of being the largest supplier of feedstock and components needed for the energy transition.

REFERENCES