Uncertainties in Hydrogen Project Finance

In our previous articles we focused on technical and security issues related to hydrogen renewable energy, being aware of the interest it arouses among companies and professionals who want to take up a position in this sector. Here we change the technical and safety aspects to enter the economic and financial world of renewable hydrogen, as we are aware of the interest of financial institutions and investment groups in this sector.

There is great uncertainty about future cash flows in hydrogen projects as there are some variables that have not been tested under real conditions, such as equipment operating hours and their link to the renewable production curve. In addition, for many of the business models that we have developed, the projects still require external financial support to become profitable.

Therefore, from SynerHy we decided to include this article, highlighting some of the most important factors and variables to consider when initially developing a renewable hydrogen project in order to reduce the investment risk and ensure the maximum guarantee in terms of future cash flows.

Hydrogen consumption, final usage and dimensioning

It is perhaps one of the most important considerations when analysing a renewable hydrogen project. It is undoubtedly the first question that SynerHy asks our clients: What will be the final use of the hydrogen produced?

The capacity of production and the final sizing of the infrastructure for a hydrogen project are entirely dependent on the estimated consumption when the production plant is put into operation. For example, in mobility projects, it makes no sense to acquire a fuel cell vehicle (FCEV) without having a refuelling infrastructure (HRS) to ensure its normal operation, just as it makes no sense to build a production, storage and refuelling infrastructure without having a minimum fleet capable of consuming the renewable hydrogen produced. Infrastructures and demand must come together and must be analysed by shared management and control systems.

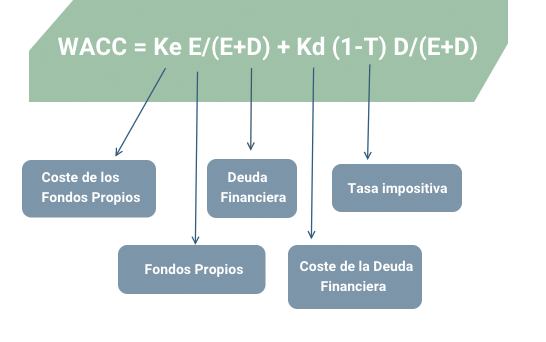

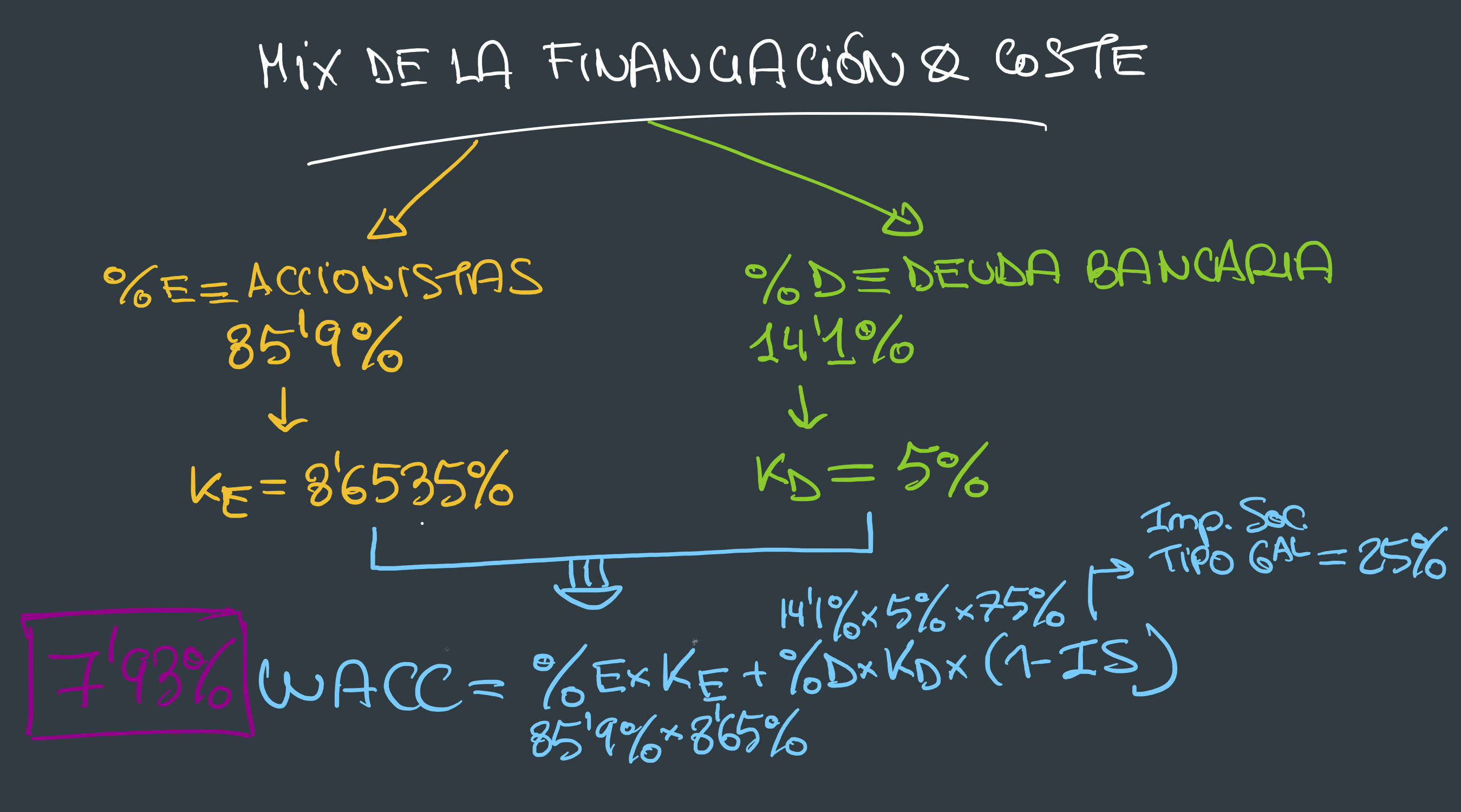

WACC (Weighted Average Cost of Capital)

This variable refers to the interest rate at which the promoting company can finance a project. This is a particular case for each company, where groups with more financial strength will have advantages over smaller companies. The WACC is even more significant for hydrogen projects due to the high CAPEX to which they are tied. In addition, financial institutions realise that this sector is not yet fully mature and therefore financing is linked to higher interest rates, which has a negative effect on future cash flows.

The sector expectations are for this WACC to be progressively reduced over the years and the ongoing financing mechanisms for sustainable projects. Moreover, cost reductions in equipment associated to the hydrogen value chain by implementing scale economies in production over the next few years will reduce the impact of this interest rate.

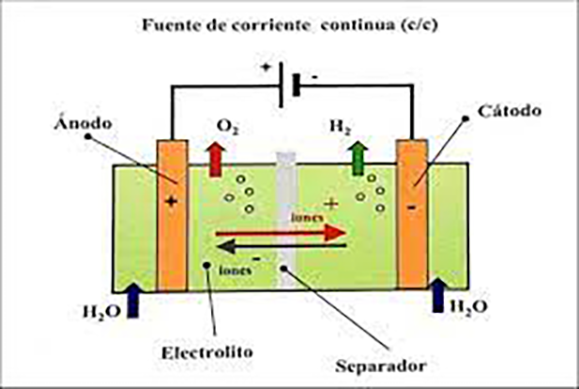

Equipment degradation

As essential as uncertain. The degradation over the lifetime of mature projects such as photovoltaic production is known based on experience. For hydrogen projects, there are many components which have a high degree of uncertainty.

For example, the stack of electrolysers, the core of a hydrogen production facility, still offers no certainty about its lifetime and even less about its stability under different operating conditions. Manufacturers propose a lifetime of between 35,000 and 100,000 hours, based on their technology, although the actual guarantee they offer drops to half of this.

However, in no case have these hours been tested beyond laboratory tests which do not represent the normal operation of an industrial production facility, and even less associated with a variable load as in the case of a renewable plant, except for low/medium power atmospheric alkaline electrolysers.

This degradation will affect mainly by two ways. First, the amount of hydrogen and oxygen produced will decrease over the years, increasing the heat produced by the electrolysis system. Therefore, we will have to oversize the electrolyser if we have to ensure a certain amount of gases to a customer. Moreover, the income will also diminish from year to year. Second, membranes and other components will have to be replaced when they reach a limit of degradation, leading to future reinvestments that must be planned for in our future cash flows. This also provides uncertainties since the costs of a stack are not known today within the next ten years or so.

Use of the PPA (Power Purchase Agreement) rate

Despite having a renewable park directly connected to our hydrogen production plant, it will be important to have a grid back-up that certifies the renewable origin of the hydrogen. The objective is to maximise the operating hours of the electrolysers, reaching a use ratio of 50-60%.

Electricity will be responsible for 60% to 90% of the hydrogen’s final costs, so it is essential to look for support to guarantee stable and competitive prices against other hydrogen production facilities. It is recommended to slightly oversize the associated renewables compared to the electrolyser, with the aim of increasing the operating hours of the electrolyser, whilst taking into account that excessive oversizing can also result in electricity surpluses at specific times.

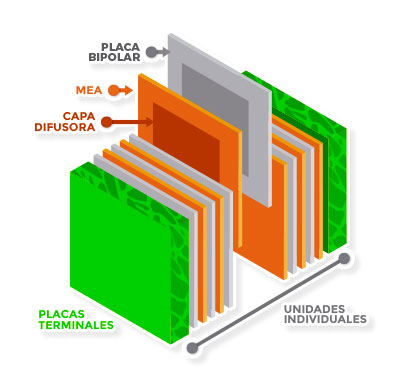

Selecting the electrolysis technology

As stated at the beginning of this article, to analyse any hydrogen project from an economic perspective, we must be aware that the final target must be to fulfil a real demand for hydrogen. Furthermore, the type of electrolysis technology selected will also play a very important role in analysing the economic performance of the project.

Moreover, the technologies currently available show differences in terms of cost, efficiency and even technological maturity that allow us to reduce or increase the consumption of resources such as electricity (by sizing the associated renewable facilities), the space required (which can increase the cost of the project) or, as mentioned above, affecting the interest rate at which the project is financed (alkaline technology is more mature than PEM technology, which means greater bankability for financial institutions and investment groups).

Alkaline

PEM

SOFC

Sale of sub-products

Oxygen and heat are two extremely interesting sub-products in renewable hydrogen production projects. The fact that these sub-products can be marketed and sold to increase the profitability of the project, without almost any additional equipment.

While low temperature heat (60-80º) has a potential market especially in district heating, the oxygen produced from electrolysis is of very high purity so it can be used in almost any current oxygen market. However, in order to be able to commercialise both sub-products, it will be required to place the hydrogen production plants close to these customers, since the different transport and transformation processes may exclude the viability of this sale.

We at SynerHy work with cash flow models in which we take into account the factors and variables detailed above, among more than 50 other parameters involved, which allow us to analyse the projects in which we are involved as realistically as possible.

REFERENCES