EEX auctions for H2 production confirmed for 2024

Renewable hydrogen, produced from renewable energies, has been identified as one of the great hopes for a climate-neutral future. The main objective of the renewable hydrogen industry is to promote an emission-free energy carrier and to be able to replace fossil raw materials for industry and society in general. This requires the production of huge quantities of green hydrogen. According to estimates, production in Europe alone is expected to reach 20 million tons per year by 2030.

To date, renewable hydrogen is generally only produced in pilot projects in research or demonstration plants, i.e. in very small quantities and at very high prices. Moreover, there is no developed infrastructure for transporting it by pipeline. Before companies analyse the feasibility of their investments for its production, it is necessary to know what level prices will stabilise and who will be the main suppliers of H2 in the future.

We are therefore faced with the classic “chicken and egg” siuation. If there is not enough renewable hydrogen, industry will not change its production systems. And if the industry does not demand large quantities, almost nobody will invest money in the production of green hydrogen.

From SynerHy we have analysed in other blog articles the different existing instruments to try to encourage and accelerate the scaling up of the industry. This week we want to analyse in detail how institutions such as the European Energy Exchange (EEX) are trying to stimulate the renewable hydrogen industry through auctions.

Figure 1. EEX Logo. Source: European Energy Exchange

EEX (European Energy Exchange)

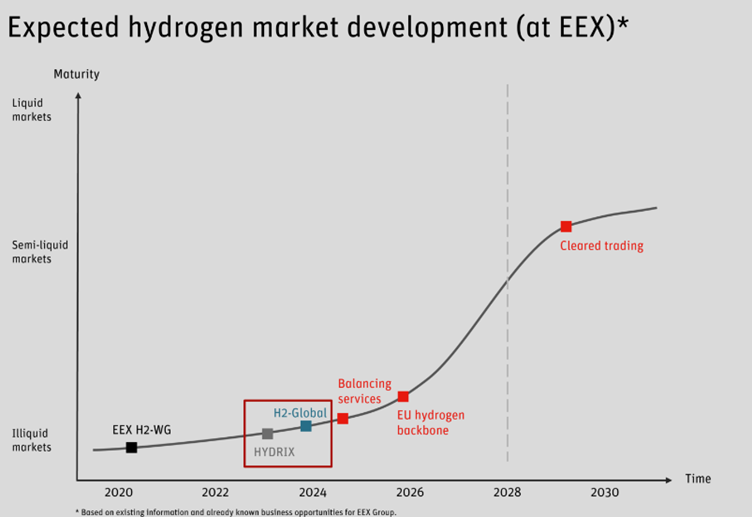

The European Energy Exchange (EEX) wants to boost and increase the production and trade of renewable hydrogen and derivatives from 2024 with the arrival of the first auctions. The EEX aims to stimulate and energise a market such as the green hydrogen market, which is still in its early stages of operation and deployment. EEX identifies that, so far, the production of green hydrogen has been very low in Europe. They identify that, first of all, the corresponding capacities must be built to ensure the necessary production, as well as a mass hydrogen transportation network. Only then can develop a sufficiently dynamic and abundant market. EEX’s main objective for renewable hydrogen is to help shape the development of the market.

Last year, the Leipzig-based stock exchange group with more than 1,000 employees recorded record sales and profits. Total revenues rose by 19 % to 575.6 million euros. According to the company, this was achieved thanks to a higher trading volume, new business products in Switzerland, Croatia, Japan and the admission of more than 80 new participants.

Following the turmoil in the energy markets caused by Russia’s invasion of Ukraine, electricity and gas prices are on the rise, causing wholesale market activity to fall, with more and more electricity being traded on the energy exchanges. Last year, for example, EEX consumed 8,661 terawatt hours, an increase of 36% over the previous year. By way of comparison: gross electricity consumption in Germany as a whole was 517 terawatt hours in the same year.

EEX is mainly concerned with electricity and gas trading, but also with CO2 emission allowances. A distinction is made between short-term contracts (spot market) and longer-term transactions (futures market), with electricity being traded up to 10 years in advance.

EEX Hydrogen Auction

EEX has developed a platform for future technical implementation in the form of auctions and other trading instruments for hydrogen and its derivatives. The idea was driven by the energy stock market last June 2023, when EEX signed a first letter of intent with Hintco (a subsidiary of the Leipzig-based H2Global Foundation). Under the terms of the agreement, EEX will allow Hintco to conduct auctions of renewable hydrogen and its derivatives. The platform will enable a competitive, transparent, and non-discriminatory auction format. In addition, it will facilitate the deployment of renewable hydrogen in the market in a competitive manner.

With the support of market participants, EEX intends to use its decades of experience in energy trading to sustainably increase liquidity in the renewable hydrogen market. Through a pooling of supply and demand for renewable hydrogen-related products, it will create transparency in the market. The first Hintco auctions on the EEX hydrogen platform are expected to take place towards the end of 2024.

German double auction system

Germany is promoting double auction mechanisms for the dynamisation of the hydrogen market in Europe. The mechanism consists of purchasing green hydrogen or derivatives such as ammonia or methanol in non-EU countries by auction in a first step. Whoever can deliver the largest quantity for a given amount gets the contract and thus the guarantee that production will be maintained at a fixed price for ten years. This creates security for potential producers to invest in the production of green hydrogen on an industrial scale in the long term.

In a second step, the purchased green hydrogen derivatives will be sold again at auctions throughout Europe. Since hydrogen prices are assumed to rise as regulatory incentives and changing consumer behavior drive up its value, these second auctions are only scheduled with a short lead time.

The German Federal Ministry of Economics and Climate Protection provided around €0.9 billion for the first auction round in 2022 and has pledged a further €3.53 billion for the next auctions. In addition, the Ministry of Digitalisation and Transport has pledged an additional €1.4 billion for another additional auction.

German engineers and economists Timo Bollerhey and Markus Exenberger set up the non-profit foundation H2Global and the subsidiary Hintco to channel such auctions. The first auction for potential producers of green hydrogen derivatives was launched in early December 2022. Bids came in from all over the world, from South America, the Asian region, Africa… but a very clear focus of interest is the MENA region, i.e. North Africa and the Arabian Peninsula. This shows how far the industry has already progressed and has been waiting for the signal that they can get a contract acceptance secured for a longer period of time.

Figure 2. Schematic diagram of the H2Global Instrument. Source: H2 Global Stiftung

With the help of H2Global, Germany has been quick to accelerate the growth of the renewable hydrogen market. Along with the auctions of the European hydrogen bank, they are the European mechanisms for boosting the hydrogen industry at the European level. The first pilot auctions for green hydrogen production were held in autumn 2023. Since Hintco does not consider the European hydrogen bank to be a competition.

The EU still considers itself in a good position, even if it is aware of the ambitious IRA plans of the Biden administration in the USA. “Hydrogen is an industry where the EU is still far ahead of global competition,” said Commission Vice President Frans Timmermans. “More than 50 percent of installed electrolyser capacities and more than 50 percent of electrolyser manufacturing capacities are located in the EU,” he stressed. However, this could soon change, because the U.S. will also need huge amounts of green hydrogen in the future.

Figure 3. Prospects for the development of the renewable hydrogen market. Source: EEX

HYDRIX Platform

In 2020, more than 100 companies from across the global hydrogen industrial value chain have collaborated in the EEX working group with the aim of establishing transparent, sustainable and non-discriminatory hydrogen trading markets as soon as possible.

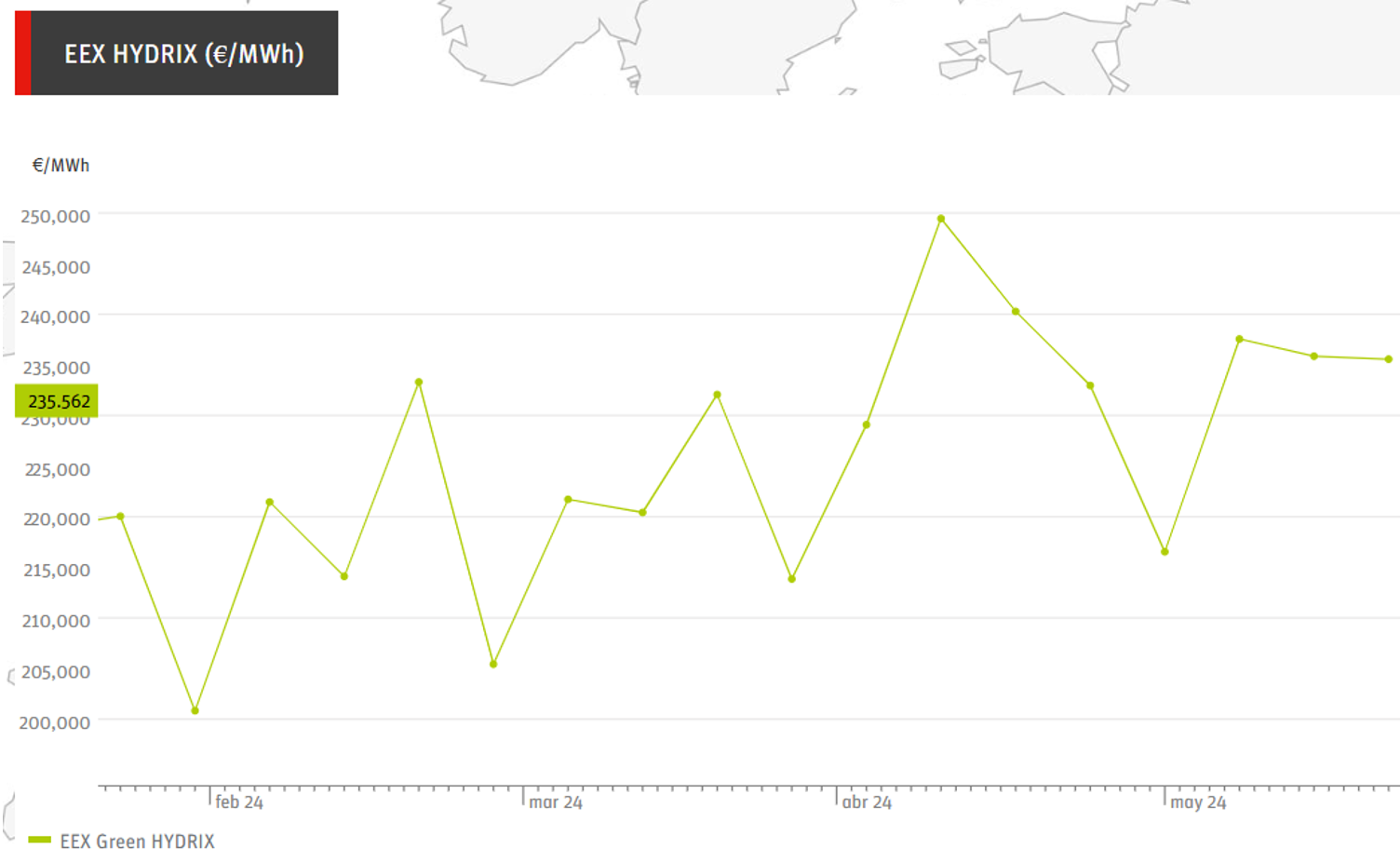

Since May 2023, EEX has been publishing the first global hydrogen market index every week with the intention of accelerating market take-off. As a result, much-needed hydrogen price transparency has been created through a trading platform.

This platform is established by means of supply and demand prices for green hydrogen on the German market, offering market participants, regulators and policy makers the following advantages:

- Price indicators to evaluate existing and new investments and commercial transactions based on the market.

- Prices derived directly from the hydrogen market, rather than derived indirectly and exclusively through hydrogen substitutes, electricity and natural gas.

- Direct comparison of hydrogen prices in €/MWh with quoted gas and electricity prices.

- Transparency on the current and historical evolution of hydrogen prices.

This platform calculates the average value of supply and demand, and is updated on the EEX website (https://www.eex-transparency.com/hydrogen) every Wednesday at 16:00.

Figure 4. Hydrogen prices €/MWh according to EEX. Source: EEX

Conclusions

Europe expects to produce around 20 million tons of renewable hydrogen per year from 2030 onwards, but if the capacity to produce it does not exist, industry will not change its production systems. At the same time, if industry does not demand large quantities, almost no company will be interested in investing money in producing green hydrogen in large quantities.

In an attempt to solve this industrial dilemma, mechanisms such as auctions create security for potential producers by encouraging and boosting a long-term market. Auctions such as the European Hydrogen Bank (production in Europe) or EEX (global character), supported by the experience of H2Global and its subsidiary Hintco, aim to boost the market both at European and global level. The results of the first auctions may help to scale up the hydrogen production industry and derivatives, but they also leave doubts regarding very low premiums for 10 years that really make this type of projects viable. The conclusions for future auctions and the dynamisation of the sector are key. It seems that shortening the production start-up periods of the projects and compliance with the stipulations of the final versions of the Delegated Acts of the Renewables Directive may pose barriers to the implementation of renewable hydrogen in the market in a competitive and safe way at European level.

The development of a platform by EEX for the future technical implementation in the form of auctions and other trading instruments for hydrogen and its derivatives, together with the expertise of the H2Global Foundation (Hintco) and the safeguarding of the German government, are indispensable for the future dynamisation and stabilisation of the sector.

REFERENCES